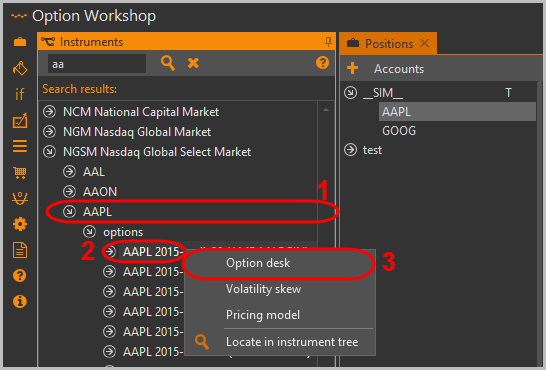

Option desk is a common way of representing an option series. It allows you to see all basic scalar parameters for all contracts simultaneously (Fig. 1).

Fig. 1 – option desk

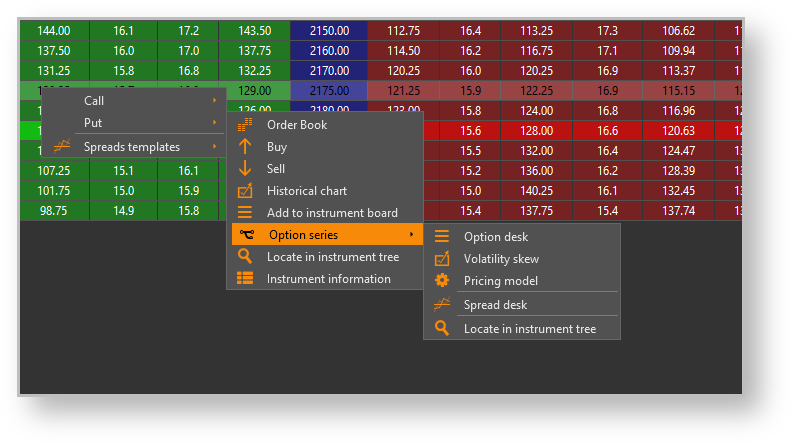

Opening option desk

Option Workshop offers two ways to open option desk:

- Double-click on the desired option series in the Series window;

- Open context menu for the desired series by right-clicking on series in the Series window, then select the Open Grid command from menu (Fig. 2).

Either way, an option desk window will be opened.

Fig. 2 – opening option desk

Working with option desk

Option desk is basically a table with the following columns:

- strike price;

- market volatility;

- Greeks;

- theor. prices;

- best bid/ask prices.

All columns (with the sole exception of Strike price column) exist in two copies – one for call options and one for put options. Call option columns are filled with green color while put option columns are red. You may configure which columns will be visible by clicking . The following dialog will open (Fig. 3).

Fig. 3 – columns selection

Use the checkboxes to specify which columns you wish to see on the option desk, then click the OK button to apply changes.

Columns can be also reordered. Press the left mouse button on the column and drag it while holding the left mouse button down. Releasethe mouse button to drop the column in its new place.

Column settings will be saved so they apply automatically in upcoming Option Workshop launches. If you want to return to default settings, click .

Fast orders

If you want to place an order on an option, you may do it directly from option desk (Fig. 4). Double-click on the desired row to open a pre-filled Place order dialog. If you click inside any put option columns then put options from the current series with the selected strike will be selected. Otherwise call option will be selected.

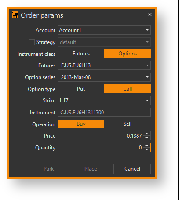

Fig. 4 – order params

You may also right-click on option desk row to open the context menu and use menu command Buy or Sell (Fig. 5).

Fig. 5 – the context menu

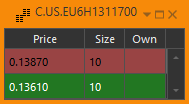

Order book

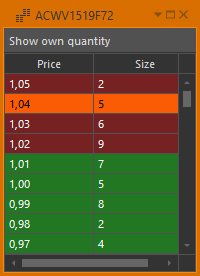

Order book is a handy way of representing active orders, including orders you have placed. There are two kinds of order books available from option desk - futures order book and option order book. Order book is a table with 3 columns:

- Price – price of orders;

- Size – size of orders (including orders you have placed);

- Own – size of orders you have placed.

Option order book

You can open an order book for any option on the option desk. Right-click on the desired option and select the Show order book command from the pop up menu. An order book window will be shown immediately (Fig. 6).

Fig. 6 – an order book

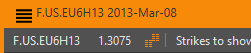

Futures order book

You can also open an order book for an option series' base futures (Fig. 7). Click to open futures order book.

Fig. 7 – futures order book

NOTE: Option series base futures' ticker symbol and current price are shown in the option desk's toolbar