What-if scenarios are powerful tools to analyze your strategies under certain conditions. Option Workshop contains the integrated functionality to create, edit and apply what-if scenarios. What-if scenarios can be applied to strategies' positions and to strategies' charts.

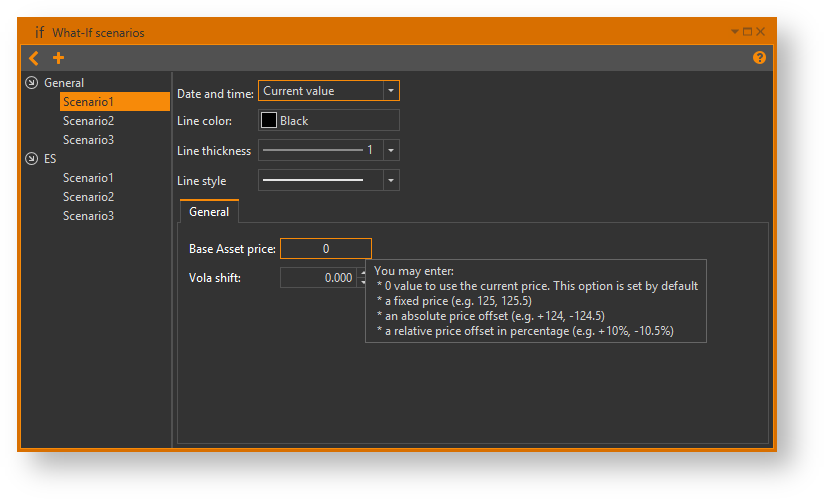

In order to create a new what-if scenario or edit an existing one, open the What-if manager first. Click  on the application toolbar and the following window will pop-up.

on the application toolbar and the following window will pop-up.

Fig. 1 –

Select a commodity from the commodity list on the left first. Then click  button on the toolbar to add a new what-if scenario. You will see the following dialog

button on the toolbar to add a new what-if scenario. You will see the following dialog

Fig. 2 – Fig. 3 –

Enter the scenario's name and confirm your input by clicking the OK button or pressing the Enter key. After that, the new scenario will be created and you will be able to edit it.

In order to edit a what-if scenario, select a commodity from the commodity list first, then select the desired scenario from the scenarios list in the middle.

After you do that, the what-if scenario editor will be shown on the right side of the window and you may make changes to the selected scenario:

This parameter defines a way the what-if scenario will override date and time values. There are 3 options:

This parameter defines a scenario's chart line color on strategy charts . You may select any color using the color picker palette.

You may override the current price value for each futures on the current commodity. There are a few ways to do this:

This option is set by default.

Examples:

125.5, 125.0, 125.

The final price value will be defined as

Pfinal = Pmarket + Poffset |

Examples:

+124.5, -124.5, +124, -124.

Relative price offset - enter a signed decimal value (positive or negative) with trailing percent sign to set a relative price offset.

The final price value will be defined as

Pfinal = Pmarket * ( 1 + Poffset% / 100% ) |

Examples:

+10.5%, -10.5%, +10%, -10%.

You may override the current volatility value for each option series on the current commodity. There are a few ways to do this:

Enter a positive or negative number, which will be added to volatility values of all options in this series.

There are a few options to define custom volatility:

0 into the text field to disable custom volatility for current strike.This option is set as default.

Examples:

0.123, 10.234, 1

The final volatility for the current strike price will be defined as

Vfinal = Vmarket + Voffset + Vshift |

Examples:

+10.5, -10.5, +10, -10.

Relative value - enter a signed decimal number with trailing percent sign to set the relative volatility offset.

The final volatility for current strike price will be defined as

Vfinal = Vmarket + Voffset + Vshift |

Examples:

+10.5%, -10.5%, +10%, -10%.

Note that customized volatility values are displayed with bold font in the table. Values displayed with normal font represent current market volatility values.

Note that Vola shift and Custom vola options can be used together, thus Vola shift will affect results of Custom vola as you may see in formulas above. |